The Senate has issued fresh order to CBN over the cash withdrawal policy as it called on the apex bank to make upward adjustment of the proposed N100, 000 per week for individual and N500, 000 per week for Corporate bodies in response to public outcry.

This plans by the Central Bank of Nigeria ( CBN) to limit cash withdrawal by any individual to N100,000 and Corporate bodies to N500,000 per week from January 9, 2023 has Divided the senators as they view it from different perspective.

They also kicked against the timing.

Senators who kicked against the proposed policy, said that Nigeria was not ripe for it as the rural people would suffer, describing it as nonsensical, vague, nebulous and anti- people, just as they warned that it may lead to mass revolt in the rural areas across the country.

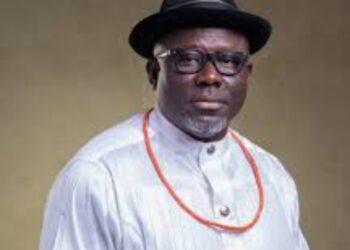

The Upper Chamber has mandated its Senator Uba Sani, APC, Kaduna Central led Committee on Banking, Insurance and other Financial Institutions to embark on aggressive oversight of the Bank on its commitment to flexible adjustment of the withdrawal limit and periodically report outcome to the Senate.

The Senate however supported the CBN in the continuous implementation of transformational payments and financial industry initiatives in line with its mandate in accordance with the CBN Act.

Resolutions of the Senate on Wednesday were sequel to the adoption of the report of Banking, Insurance and other Financial Institutions after heated debate by Senators on the proposed policy after the presentation by the Chairman.

In his presentation of the report, Senator Uba Sani argued that the planned Cash Withdrawal Limits was well conceived by the CBN for transformation of the Nation’s economy and that the action falls within the mandate of the Apex bank as provided for in section 2(d) and 47 of its extant Act.

According to him, the implementation of the Cashless policy in 6 states resulted in reduction in the cost of currency management by 15.20% from N36 97 billion to N31.35 billion between 2013 and 2014. The trend however reversed in 2014 following the suspension of cash deposit charges in the six states currency handing cost increasing by 17.20% between 2014 and 2015 following the suspension. The cost of currency management has been on the increase since then, Total cost of currency management for 10 months to end October 2022 was N47.25 billion.

During debate on the report and recommendations that were later adopted as resolutions, Senator Ajibola Basiru, APC Osun Central who said that the proposed threshold of N100,000 and N500, 000 withdrawal per week for individuals and corporate bodies respectively was unrealistic, said, ” Laws are made for people and not people made or created for law .

If CBN is acting under section 2(d) and 47 of its extant Act to make life difficult for Nigerians through a policy , as representatives of the people, we need intervene. vanguard